Remember that thrill when you got your first checking account — that feeling of freedom and independence? And for those first few months, keeping an eye on your balance and even using your checkbook register (paper or virtual) seemed fun and important.

Yeah, remember that? So when was it that managing your checking account became a tedious bore, something that could be pushed off “until tomorrow”? How long did it take before you started avoiding managing your account, feeling content (and maybe just a little bit guilty) to check it only once in a while — like when you’re worried you might have written one check more than your balance can cover? How long before the feelings of newness and pride wore off? Three or four months? Probably.

It’s true, balancing your checking account isn’t exactly glamorous. And in the world of chores, it ranks about the same as dusting — you do it once, and the next thing you know, the whole process has to be repeated all over again. What’s the point in doing it every week or even every month?

Obviously, when it comes to dusting, the point is cleanliness — getting rid of germs, dust, and spores on a regular basis means fewer allergies and colds, as well as greater comfort for you and for any guests you may have. As for your checking account, the consequences of failing to manage it on a regular basis tend to be more dire than hosting conventions of dust bunnies under your bed. When you let your checking account go untended, you can wind up unintentionally bouncing checks, which means you can also accrue some pretty hefty overdraft and returned check fees. Plus, there’s always the risk that someone may have used your account information illegally to make purchases or even withdraw or transfer cash to an external account. Managing your checking account on a regular basis also helps you stay in control of your budget and stay on track with your financial goals, whatever they may be. And there’s always the small risk the bank itself will make an error, either misapplying a deposit (that is, crediting your deposit or another account) or deducting incorrect costs or fees from your account.

What’s more, even though it may not compete with, say, videos of cute cats or a spirited Reddit debate on the pros and cons of the Game of Thrones ending, managing your checking account really isn’t as difficult or tiresome as you probably think it is. In most cases, a once-weekly review takes well under a half hour — only a few minutes if you do it daily, which is really the preferred way to balance a checking account.

Balancing your checking account: The basics

So first, what does it mean to balance your checking account? Balancing your account simply means you deduct outstanding checks from your existing balance to make sure you’re not on the road to an overdraft. You might be wondering if you can’t achieve the same thing just by checking your balance on a daily basis. Good try — but the answer is no. Your daily balance just shows what’s in your account at that moment; it doesn’t take into account any outstanding checks that haven’t cleared yet (or any pending autopayments that are about to decrease your balance).

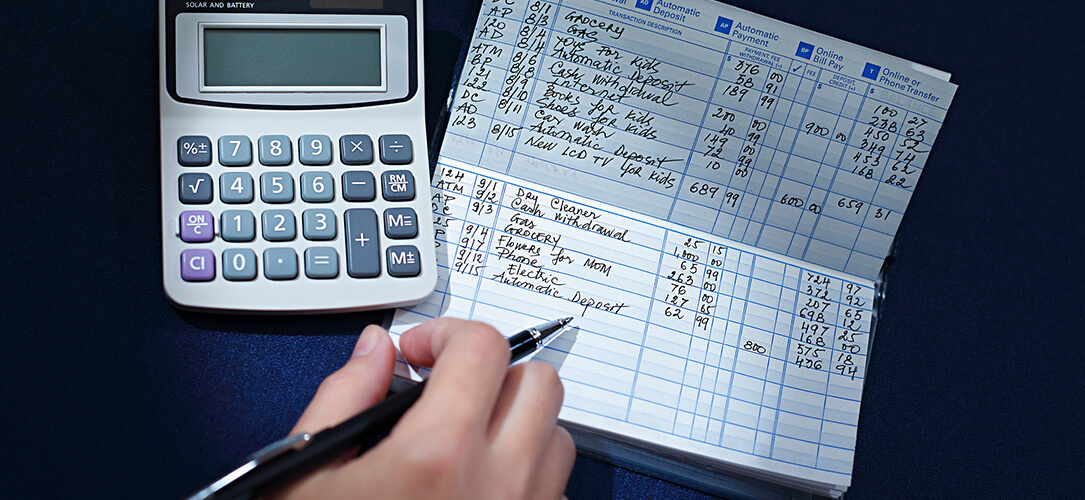

To be really accurate and reduce the risk you’ll accidentally “bounce” a check or cause an overdraft from a forgotten autopayment, you should deduct each and every expense that draws from your account when it occurs — so if you write a check at the dentist’s office, for instance, you should record it in your check register (either a paper one or an app version is fine, as long as you use it) and deduct it from your current balance right away — yes, while you’re still in the dentist office. Recording the transaction right away instead of promising to do it “when you get home” ensures you don’t forget to make the deduction so you don’t have an overdraft in the future. It also provides you with an ongoing and accurate record of your current balance, which can be really important for preventing fees for bounced checks and overdrafts.

Of course, to make the whole balancing thing work, you need to keep track of autopayments as well — for instance, if your phone bill or electric bill are automatically deducted from your checking account, you’ll need to remember to deduct those amounts in your register when the payments are withdrawn. Otherwise, you can wind up with multiple bounced checks — and multiple overdraft fees. Considering a single overdraft fee can be $30 (or more), it’s easy to see how having several bounced checks can have a big impact on your finances.

Overdraft protection: Do you need it?

It’d be nice if banks offered an option to help you prevent the financial impact of bounced checks, wouldn’t it? Well, that’s kind of what overdraft protection does — only not quite. Overdraft protection means that if you swipe your debit or ATM card or write a check for an amount that exceeds your current account balance, your bank will still let the transaction go through. Nice of them, right? Well, not really. Overdraft protection comes with a fee — and it can be hefty. That $3 coffee you paid for with your debit card this morning? If your balance won’t cover it and overdraft protection kicks in, that cup of java could wind up costing your $33 or more when you add in the overdraft fee. And if you don’t cover the overdraft amount right away, your bank could keep hitting you with additional fees until you do. All those fees (and sometimes interest on the amount) add up — quickly.

Of course, if you manage your checking account on a daily basis, deducting checks and autopayments right away, you’ll know your balance — and you can opt for a cup of homemade coffee, instead. It’s one more way managing your checking account works in your favor.

Online and mobile banking: A dream come true? But hey, this is the tech generation, right? Who uses paper and pen any more? Of course, there are several apps and programs that let you manage your checking account and keep an up-to-date balance. Mobile banking options are especially nice, because they let you balance your account on the fly, no matter where you are. With that kind of convenience, there’s no excuse for not balancing your checking account and keeping an eye on your account activity on a daily basis. Pretty much everyone can find five or 10 minutes during their day to log in to their account, record a transaction or two, and check their account activity. (And if you’re too busy with your job and your multiple side hustles to be bothered with investing the minimal time it takes to manage your account, hopefully you’re making enough money to hire a virtual assistant to handle the task for you.)

So maybe dusting isn’t the best analogy. When it comes to chores, managing your checking account is actually a lot more like brushing your teeth: All it takes is maybe a 10-minute investment of your time each day, and you can keep your teeth — and your finances — in good shape for the rest of your life.

Lisa Kroulik is a freelance content marketing writer with eight years of experience. She has a special interest in helping readers make sound financial decisions and financial recovery topics. After having filed bankruptcy in 2008, Lisa took the opportunity to make a fresh start and learn from her mistakes. Today she has a credit score of 830 and no debt other than a mortgage.