Have you ever paid a bank fee just to store your hard earned money? Such bank fees can be avoided with smarter banking practices. One such practice includes opening a checking account.

With a free checking account, you can avoid paying interest and make your daily bank transactions easier. Here is what you need to know about checking accounts and how they can help you avoid surcharges.

What Is A Checking Account?

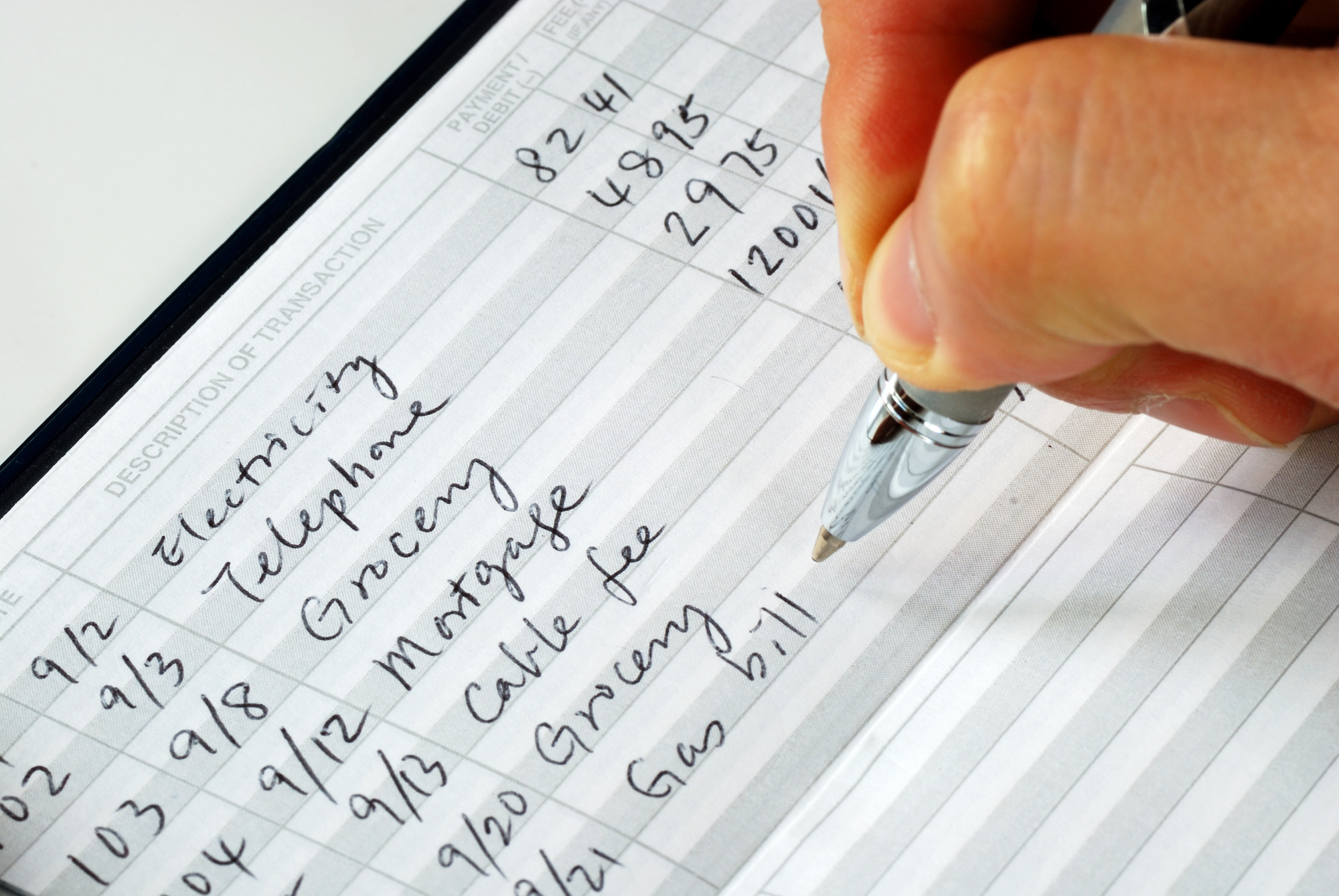

A checking account is a deposit account that allows numerous cash withdrawals & unlimited deposits. Commonly also known as demand accounts or transactional accounts, checking accounts can be accessed using ATMs and checks, among other methods. Unlike savings accounts, which could limit cash deposits or withdrawals, a checking account enables easier banking.

How To Avoid Paying Surcharges

Use a Free Checking Account: By setting up a free checking account, you can save on interest fees. Some banking institutions offer free interest-bearing checking accounts- so make sure you take advantage of this.

In case your bank doesn’t, you can also find another bank that allows you to open an account for free. Other banks offer checking accounts for a minimum fee- as opposed to setting up another account type, which could charge you a higher fee.

Using Bank App Notifications: Most banks with checking accounts have apps that can help you stay on top of your bank accounts. Mobile banking alerts can easily and conveniently notify you of your balances, transfers, payments and other transactions. You can avoid those costly surcharges especially those pesky overdraft fees by setting up your notifications to let you know when your balance is below a certain amount.

Maintain a Minimum Balance: Although a checking account allows unlimited withdrawals and deposits, it helps to maintain a minimum balance. This allows you to save on paying an interest fee. Maintaining a minimum checking account balance can also help you avoid any accidental overdrafts.

Use An ATM Affiliated To Your Bank: You can also avoid paying additional ATM fees by using an ATM that is owned by your bank. Most popular banks have ATMs all over the country, but you might also have to look them up.

Pay Your Bills Online: With advances in electronic banking, a checking account is easier to use. You can pay your bills using electronic transfers. This eliminates the need to write a check and saves your time.

You can also make your monthly payments automatic and use applications on your smartphone to conduct your transactions smoothly. This ensures that you never miss the deadline to pay your bills.

You will no longer have to worry about banks charging you for accessing your own money. Save on additional fee charges: open a checking account today and make all your transactions easier and smoother. Manage your payments the smarter way!

Lisa Kroulik is a freelance content marketing writer with eight years of experience. She has a special interest in helping readers make sound financial decisions and financial recovery topics. After having filed bankruptcy in 2008, Lisa took the opportunity to make a fresh start and learn from her mistakes. Today she has a credit score of 830 and no debt other than a mortgage.